Why International Payments Fail and How to Improve Success Rates

For global merchants, international payment failures are often dismissed as “issuer issues” or “random bank behavior.”

They are not.

Most international payment failures are systemic, predictable, and fixable. And if you do not actively design for success, they quietly show up as:

Lower checkout conversion

Higher acquisition costs

More customer support tickets

Worse unit economics as you scale internationally

This guide breaks down:

Why international payments fail far more than domestic ones

What card networks, issuers, and processors actually penalize

How high-performing global merchants improve success rates

How xPay structurally improves international payment acceptance for Indian businesses

1) Why international payments fail more than domestic

A domestic payment is simple. An international payment is not.

In a cross-border transaction, you are dealing with:

A card network

The customer’s issuing bank

A processor or gateway

Acquiring banks

Currency conversion

Local and international regulations

Fraud and risk engines across multiple layers

Each additional layer introduces new failure points.

This is why international payments consistently see lower approval rates compared to domestic transactions, even for legitimate customers.

2) The most common reasons international payments fail

a) Issuer risk and fraud controls

Issuing banks are significantly more conservative with cross-border transactions.

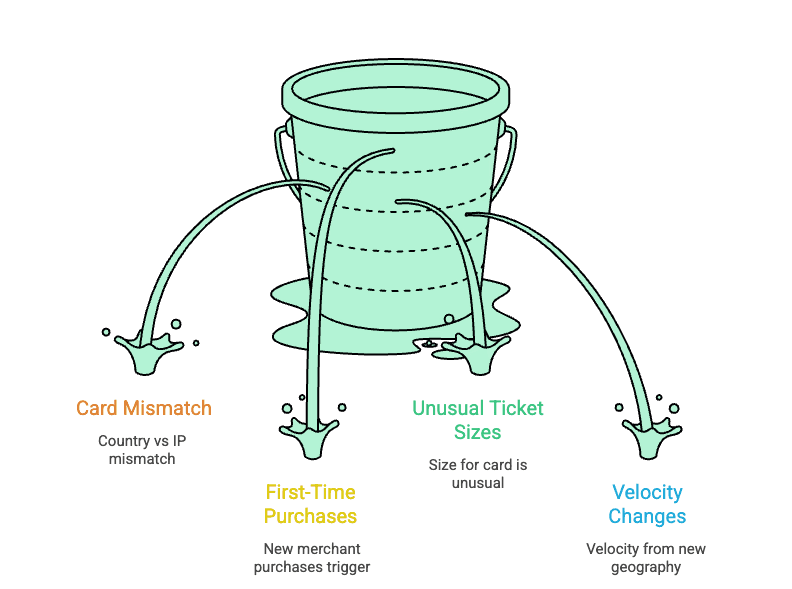

Common triggers include:

Card country vs IP or device mismatch

First-time merchant purchases

Unusual ticket sizes for that card

Velocity from a new geography

Many declines labeled as “fraud” are actually issuer uncertainty, not real fraud.

b) Missing or incorrect compliance data

For Indian merchants in particular, international payments require additional metadata:

Correct purpose codes

IEC or equivalent documentation

Transaction classification accuracy

If this data is missing or misconfigured, payments may be declined, delayed, or blocked at settlement.

Stripe’s own documentation for Indian merchants highlights how critical these details are for reducing declines and compliance issues Stripe.

c) Currency and settlement friction

Not all issuers are comfortable with all currencies.

Some block certain presentment currencies

Some apply stricter rules to non-local currency charges

Poor FX handling increases decline probability

Showing the wrong currency at checkout is a silent conversion killer.

d) Authentication and 3DS issues

Strong Customer Authentication is required in many regions.

Failures often happen because:

3DS is incorrectly implemented

Fallback flows are missing

Authentication UX is poor

This causes customers to drop off or issuers to decline the transaction.

e) Descriptor confusion

If a customer does not recognize the merchant name on their statement:

Issuers lower trust scores

Customers abandon authentication

Disputes rise later

Descriptors are a success rate lever, not just a support detail.

3) What card networks and issuers really care about

Understanding this changes how you design payments.

Issuers prioritize:

Transaction familiarity

Location consistency

Historical success patterns

Clear authentication signals

Networks enforce:

Authentication where required

Accurate transaction metadata

Clean authorization flows

Processors penalize:

High decline ratios

Poor dispute performance

Compliance gaps

This is why payment success rate is not just a checkout problem. It is a full-stack systems problem.

4) How to improve international payment success rates

High-performing global merchants focus on three layers.

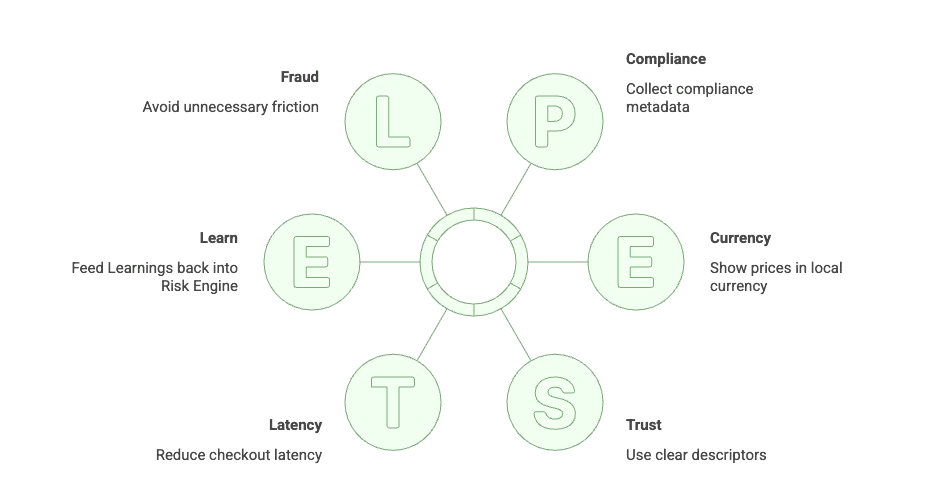

Layer 1: Prevention before checkout

Collect complete compliance metadata

Use geo-aware risk checks instead of blunt rules

Support local payment methods where cards underperform

Avoid unnecessary fraud friction for low-risk users

Prevention drives the biggest lift in success rates.

Layer 2: Optimize the checkout experience

Show prices in local currency

Use clear, recognizable descriptors

Implement 3DS correctly with fallback flows

Reduce checkout latency

Confidence reduces both declines and drop-offs.

Layer 3: Learn from failures

Track decline reasons by country and issuer

Separate soft declines from hard declines

Retry intelligently instead of blindly

Feed learnings back into risk and routing rules

Every failed payment is data.

5) How xPay improves international payment success rates

Most payment setups try to optimize success rates at the edges. xPay fixes the core structure.

Local acquiring instead of remote cross-border charging

xPay operates as a local Collection Agent for merchants.

For collection:

Payments are processed via licensed local processors and banks in the customer’s geography

Funds are settled into a local collection account

Money is then transferred to the merchant’s INR account via regulated AD1 banking channels or PA-CB providers

To issuing banks, these transactions look local or near-local, not risky foreign charges.

This materially improves authorization success.

Why local acquiring increases approval rates

Local acquiring works because:

Issuers trust local transactions more

Cross-border risk flags are reduced

Authorization latency is lower

Currency expectations align with issuer policies

Merchants see:

Higher approval rates

Fewer issuer-driven declines

Better performance in high-friction markets

Fully compliant settlement into India

Success rates do not matter if settlements break later.

xPay ensures:

Funds enter India through regulated AD1 banking routes

FEMA and RBI compliance by design

GST-compliant FIRCs issued instantly by partner banks or providers

Clean audit trails for every transaction

This removes downstream blocks, reversals, and bank interventions that quietly hurt reliability.

The net effect

xPay delivers:

Higher international payment success rates

Fewer false declines

Predictable INR settlements

Lower operational and compliance risk

Payments are designed to succeed by default, not patched after failures.

6) A 30-day checklist for global merchants

Compliance

Verify purpose code and IEC setup

Audit transaction metadata

Checkout

Enable local currency display

Improve descriptors

Review 3DS implementation

Risk

Replace blunt rules with geo-aware logic

Monitor issuer decline patterns

Operations

Track success rates weekly

Review top failing countries and methods monthly

7) FAQs

Why do international payments fail even for real customers?

Issuer uncertainty and risk controls, not just fraud.

Is improving success rates only about fraud reduction?

No. Compliance, routing, currency, and authentication matter equally.

Should merchants track success rate as a core metric?

Yes. It directly impacts revenue, CAC efficiency, and growth velocity.

Ready to Keep More of Every Dollar You Earn?

Try xPay free for 30 days - pay 0 % fees, test real results.

Start accepting Apple Pay, PayPal, international cards, and 40+ methods, with the Lowest fees and instant FIRC.

Stop leaking revenue to FX spreads, failed OTPs & wire fees.

xPay is the international payment gateway built for Indian businesses.

Get 1 Month Free – Zero Transaction Fees

Ready for clearer, cheaper global payments?