International Subscription Payments from India: How xPay Enables Global Recurring Revenue

The global economy is shifting rapidly toward subscription models. Whether you’re a SaaS platform, digital marketplace, media provider, or e-commerce business, recurring revenue is now table stakes — not an optional monetization twist. Understanding how to power subscription billing technically and compliantly is critical, especially when your customer base spans borders.

What Are Subscription Payments?

Subscription payments are recurring charges that allow businesses to bill customers on a regular schedule — monthly, annually, or at any defined interval — for access to products or services.

Unlike one-time payments, subscription billing requires:

Recurring authorization from the customer

Credit card or bank mandate handling

Scheduled collection

Fail-retry logic

Lifecycle management (upgrades, downgrades, cancellations)

Advanced patterns also include:

Usage-based or metered billing

Tiered plans

Customer self-service changes

Tokenised cards for delayed charges

Why the Subscription Model Matters Now

Across industries, businesses are moving to recurring revenue models because they deliver more predictable cash flow, higher customer lifetime value (CLTV), and stronger retention. The subscription economy continues to grow dramatically:

The global subscription economy was valued near USD 492 billion in 2024 and is projected to exceed USD 1.5 trillion by 2033 with continued demand across services and digital platforms. Grand View Research

An average consumer worldwide now holds multiple subscription services, and 32% report that subscription spending accounts for more than half of their discretionary expenditure. Marketing LTB -

Research shows that 70% of subscription revenue often comes from existing customers, highlighting the strategic value of retention and repeat billing. Cashfree

In India specifically, the subscription e-commerce market is also gaining momentum; one report projected it to grow from over USD 10 billion in 2024 to USD 374 billion by 2033. IMARC Group

These figures show that subscription payments are not a niche — they’re the backbone of modern digital monetization.

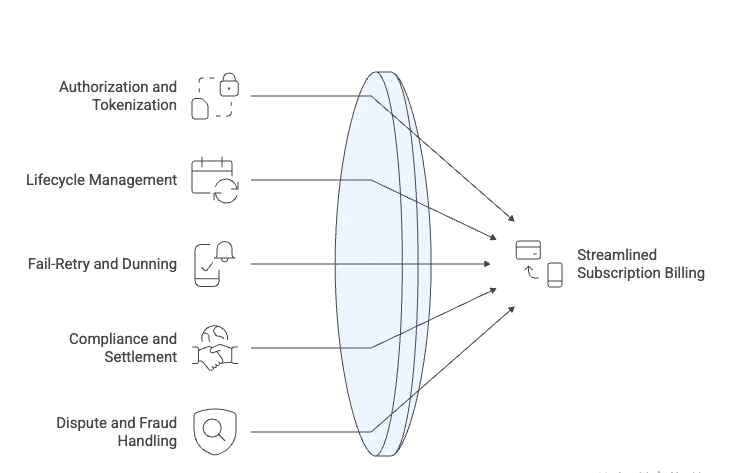

The Challenge of Subscription Billing

Unlike one-time payments, subscription billing introduces complexity:

1. Authorization and tokenisation

To bill repeatedly, you need a way to securely store credentials (e.g., tokenised cards) and retain a valid mandate for recurring charges.

2. Lifecycle management

Customers often request plan upgrades, downgrades, pauses, or cancellations. Billing logic must support changes without manual intervention.

3. Fail-retry and dunning

When a payment fails, you need curated retry logic and notifications to avoid unnecessary churn.

4. Compliance and settlement

For Indian merchants serving international customers, subscription charges must be compliant with RBI and FEMA requirements, and correctly remitted into India with documentation such as GST-compliant FIRCs.

5. Dispute and fraud handling

Subscriptions can attract friendly fraud or disputes. Good data capture and reconciliation workflows are critical for defense.

How xPay Handles Subscription Payments

xPay’s subscription engine is designed to support Indian businesses selling globally. It goes beyond simple recurring billing by addressing both developer and finance team needs.

Secure Tokenisation & Stored Credentials

xPay securely stores customer payment credentials using tokenisation. This enables:

Compliant recurring billing

“Charge-at-will” — the ability to bill a card on demand for legitimate reasons (post usage, penalties, upgrades) without re-asking for details

This capability is PCI DSS aligned, and supported by card networks’ stored credential frameworks.

This means you can bill customers automatically with confidence and without friction.

Subscription Lifecycle Management

xPay supports:

Plan upgrades and downgrades

Billing cycle changes

Pausing and resuming subscriptions

Proration and adjustment logic

These features allow businesses to reflect real customer journeys without manual bookkeeping.

You can also offer flexible pricing models (monthly, yearly, custom intervals) with accurate revenue recognition.

Charge-At-Will (CAW)

Charge-at-will lets merchants bill stored credentials for valid business reasons post-authorization. This covers use cases such as:

Usage-based charges

Overages

Add-ons

Cancellation or extension fees

All of this is done in a way that complies with global stored credential rules and minimizes dispute risk.

Fail-Retry / Dunning Automation

xPay has robust retry logic for failed subscription payments:

Intelligent retry scheduling

Customizable notification cadence

Built-in dunning workflows

This significantly reduces involuntary churn — a major revenue leak in subscription businesses.

Key Subscription Use Cases xPay Supports

xPay’s subscription handling works across verticals:

SaaS & Cloud Services – Monthly/annual plans with billing automation.

Marketplaces – Seller fees or buyer plans with periodic billing.

Digital Content Platforms – Subscription access to premium libraries.

E-commerce and Curated Goods – Auto-ship memberships.

Utilities & Platforms with Usage Billing – Mix of subscriptions with metered charges.

Enterprise Contracts – Volume-based recurring charges with adjustments.

This flexibility lets businesses scale globally without reinventing billing infrastructure.

How xPay Compares to Traditional Subscription Billing Options

Platforms like Stripe provide robust billing tools, but they are global and generalised. Most Indian businesses face these gaps with traditional providers:

Complex compliance for Indian remittances

Manual FIRCs and reconciliation overhead

Limited support for on-the-fly subscription edits

No native charge-at-will support

xPay addresses these directly with:

Built-in compliance for Indian inbound settlements

Instant GST-compliant FIRCs

Subscription editing and CAW without third-party plugins

Reconciliation automation

This makes xPay’s subscription solution particularly strong for Indian exporters of digital services.

Best Practices for Subscription Billing Success

1. Optimize your retry logic

Automatic retries with smart schedules recover more failed payments.

2. Capture rich event data

Store subscription metadata to help with disputes and analytics.

3. Support plan changes gracefully

Allow customers to modify plans without friction.

4. Monitor key revenue metrics

Focus on MRR growth and churn reduction rather than just payment volume.

5. Comply with local regulations

Ensure all inbound subscription payments into India meet FEMA and RBI standards.

Subscription Statistics You Can’t Ignore

The global subscription economy is projected to grow from nearly USD 492 billion in 2024 to over USD 1.5 trillion by 2033. Grand View Research

The global subscription model is expanding as businesses adopt recurring revenue to strengthen customer relationships and predictable income. Grand View Research

Consumers increasingly hold multiple subscriptions; the average person has more than five active subscriptions, and subscription spending represents a major component of discretionary spending. Marketing LTB -

In India, the subscription e-commerce market is poised for explosive growth, with projections from USD 10.34 billion in 2024 to USD 374.24 billion by 2033 at a very high CAGR. IMARC Group

Subscription revenue is often dominated by existing customers, with roughly 70% of revenue coming from renewals and retention efforts. Cashfree

These trends show why powering subscriptions is no longer optional — it’s fundamental to future revenue models.

Conclusion: Subscriptions Are Core, Not Optional

Subscription billing is now a foundation of modern business. It drives predictable revenue, deeper customer relationships, and better valuation multiples.

But its success depends on a robust technical and billing infrastructure, especially when payments cross borders and jurisdictions.

xPay’s subscription capabilities — including billing automation, subscription editing, charge-at-will, comprehensive analytics, and compliant international settlement — make it a strategically strong choice for Indian businesses looking to scale globally.

If your business depends on recurring revenue — whether SaaS plans, memberships, or usage-based billing — a modern subscription billing platform like xPay is no longer just nice to have — it’s essential.

FAQ's

1) What are international subscription payments?

International subscription payments are recurring payments collected from customers located outside India, where charges are made automatically at regular intervals such as monthly or annually for access to a product or service.

2) Can Indian businesses collect subscription payments from international customers?

Yes. Indian businesses can collect international subscription payments using a compliant cross-border payment platform like xPay, without setting up foreign entities or overseas bank accounts.

3) How are international subscription payments settled into India?

International subscription payments are collected from customers abroad and settled into the merchant’s INR bank account through regulated AD1 banking channels or PA-CB providers, along with proper reporting and documentation.

4) Are international subscription payments compliant with Indian regulations?

Yes. When processed correctly, international subscription payments comply with FEMA and RBI guidelines, use appropriate purpose codes, and generate GST-compliant FIRCs required for accounting and audits.

5) What payment methods are commonly used for international subscriptions?

International subscriptions are typically paid using international credit and debit cards, wallets, and stored credentials, with recurring authorization handled through tokenised payment methods.