How Cross-Border Payments Work in India (2026 Guide)

If you are an Indian business selling globally, understanding how cross-border payments work is mission-critical. Cross-border payments are more complex than domestic ones because they span multiple banks, regulations, currencies, risk engines, and settlement systems. Mistakes or misunderstandings at any step can lead to declines, regulatory issues, or revenue leakage.

This guide explains:

What cross-border payments are

How they actually flow when you receive money in India

Key actors and regulations in India

Common failure points and hidden costs

How xPay’s infrastructure improves success, compliance, and predictability

By the end, you’ll understand the full lifecycle of a cross-border payment in India — from your customer’s card swipe to INR in your bank account.

1) What are cross-border payments?

A cross-border payment is any transaction where the customer’s bank, card network, or payment processor is outside the merchant’s country.

For Indian merchants this means:

The card is issued outside India

The issuer is outside India

The currency is not INR

The settlement involves foreign exchange and regulatory clearing

Cross-border does not just mean geography. It means multiple legal and operational systems interacting in real time.

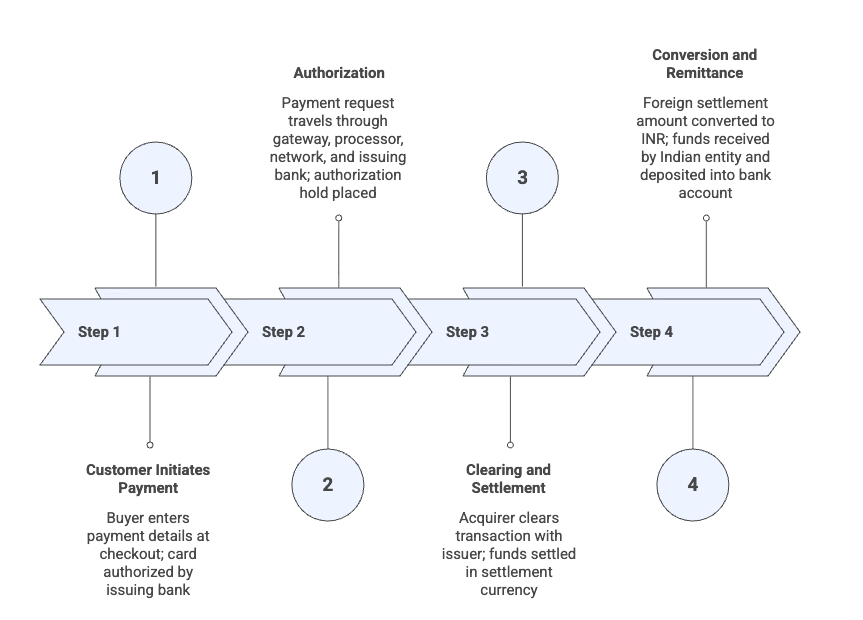

2) How cross-border payments work: step-by-step

At a high level, here is the flow from a customer purchase to settlement in India:

Step 1: Customer initiates payment

A buyer enters payment details in your checkout, typically a:

Card (Visa, Mastercard, Amex, JCB, UnionPay, etc)

Wallet or alternate payment method supported globally

The card is authorized through the customer’s issuing bank outside India.

Step 2: Authorization

The payment request travels through:

The merchant’s payment gateway

A processor or acquirer

Card network (Visa / Mastercard / Amex)

Issuing bank

The issuer decides whether to approve or decline.

If approved, an authorization hold is placed.

Step 3: Clearing and settlement

Once authorized, the transaction enters clearing and settlement:

The acquirer (or its processing partner) clears the transaction with the issuer through the network.

Funds are settled from the issuer’s bank to the acquirer’s account in settlement currency (often USD or EUR).

FX conversion is required to bring that money into INR.

Step 4: Conversion and remittance to India

This is where the international leg ends and India’s regulatory rails begin:

The foreign settlement amount is converted to INR.

The funds are received by an Indian entity either directly or via a collection agent model.

Compliant documentation (purpose codes, KYC, tax forms) is attached.

The INR is deposited into your Indian bank account.

This final leg is governed by FEMA, RBI rules, and banking regulations.

3) Regulatory and compliance requirements in India

Cross-border payments into India must satisfy several compliance points, including:

a) FEMA compliance

The Foreign Exchange Management Act (FEMA) regulates inflows and outflows of foreign exchange. Incoming foreign funds must:

Be reported to the RBI

Have correct purpose codes

Match KYC and documentation requirements

b) Purpose codes

These codes determine the nature of the transaction (e.g., sale of goods, services, SaaS export). Incorrect or missing codes cause:

Regulatory holds

Payment delays

Blocked settlements

c) KYC and documentation

Banks require:

Merchant identity proof

Export documentation

Contract or agreement details

GST and PAN details

These are necessary for foreign inflows to be credited and taxed appropriately.

d) FIRC issuance

A Foreign Inward Remittance Certificate (FIRC) is proof of foreign payment receipt. FIRCs are needed for:

GST compliance

Corporate filings

Accounting and audit

Instant, GST-compliant FIRCs remove reconciliation delays and reduce compliance risk.

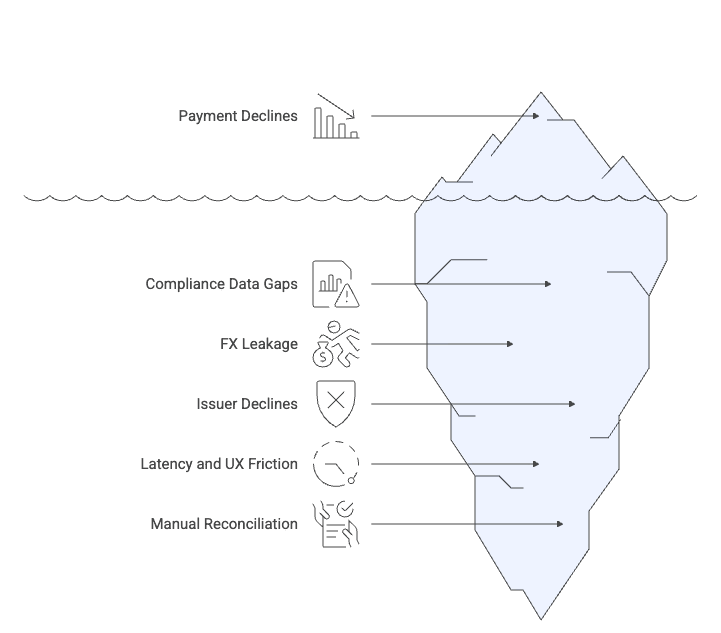

4) Common challenges Indian merchants face

Indian merchants selling abroad often struggle with:

Declines due to compliance data gaps

Missing purpose codes or IEC can trigger declines or settlement rejects.

FX leakage and poor routing

Unoptimized FX and routing layers eat into margin.

Issuer and network declines

Issuers block transactions due to high risk perception on cross-border buys.

Latency and UX friction

Authentication failures or latency kill conversions.

Manual reconciliation

Late FIRCs and settlement mismatches create accounting headaches.

Understanding why these happen is the first step toward solving them.

5) Improving cross-border payment success rates

Top global merchants optimize success with:

a) Complete compliance metadata

Purpose codes, export docs, and correct KYC data attached to every transaction.

b) Local currency display

Customers convert less often and drop declines.

c) Smart routing

Dynamic routing through multiple acquiring partners reduces declines and improves success rates.

d) Strong customer authentication

Careful 3DS design with fallback logic.

e) Data driven decline handling

Track declines by code, geography, issuer, and method.

If you apply these steps consistently, success rates rise organically.

6) How xPay’s cross-border flow works

xPay’s cross-border payment infrastructure was built specifically for Indian merchants selling globally. It solves every step of the international flow with compliance, routing intelligence, and risk-aware optimization.

1) Local acquiring and collection agent model

Rather than processing everything as a fully foreign transaction, xPay operates as a local Collection Agent:

Payments from international cards are processed via licensed local processors and banks in the customer’s geography.

Funds settle into a local collection account rather than a remote corporate account.

To the issuer and network, the transaction appears local or near-local — not a risky cross-border charge.

This significantly boosts approval and authorization success.

2) Compliance-first settlement into India

After collection, funds move into India through:

Regulated AD1 banking channels

PA-CB providers

This ensures every settlement:

Meets FEMA and RBI compliance

Is supported with correct purpose codes

Has KYC and export documentation attached

xPay also ensures GST-compliant FIRCs are issued instantly by partner banks or providers, removing reconciliation delays.

3) Legal clarity at every step

xPay’s transaction and fund-flow architecture is supported by formal legal opinions in both India and the United States. This reduces risk of:

Regulatory intervention

Settlement holds

Compliance rejections

Merchants benefit from predictability and scaleibility.

4) Intelligent routing and retry logic

xPay’s technology:

Sends transactions through optimal pathways for approval

Retries declines intelligently with alternative routes

Uses data to improve routing over time

This reduces false declines and increases success rates without manual ops work.

5) Dashboard and operational insights

xPay gives merchants:

Success rates by country, currency, and method

Decline taxonomy and trends

Settlement visibility and reconciliation support

This turns payments from a technical black-box into a growth lever.

7) A 30-day operational checklist

Compliance

Ensure purpose code setup is correct

Attach IEC and export docs to payment metadata

Checkout

Display local currency prices

Implement 3DS with fallback

Routing

Enable smart acquiring paths

Test retries on common decline codes

Reconciliation

Confirm FIRC issuance setup

Sync bank settlements to xPay dashboard

Risk

Monitor issuer decline trends

Tune fraud rules based on data

8) FAQs

What is a cross-border payment?

A payment where the card, issuer, or bank is outside the merchant’s country.

Do I need purpose codes for every transaction?

Yes. Incorrect codes are a leading cause of declines and settlement blocks.

Can international success rates be improved?

Absolutely. Routing, compliance metadata, authentication, and local acquiring all matter.

What is a FIRC?

A Foreign Inward Remittance Certificate, required proof of foreign funds received into India.

Closing thoughts

Cross-border payments are a core part of global commerce, but they are also complex because they bridge payments, compliance, and banking systems.

For Indian merchants, success requires more than just a gateway token. It requires:

Correct compliance metadata

Smart routing logic

Local acquiring

Regulatory alignment

Real-time visibility

This is how payments stop being a cost drag and become a growth engine.

If your current cross-border setup treats international acceptance as an afterthought, your revenue is leaking silently. Redesign the flow, not just the checkout.