Credit Card EMI for International Payments: A Complete 2026 Guide for Indian Merchants

Flexible payments are no longer a “nice to have” in global commerce. For high-value purchases, international customers increasingly expect the ability to split payments into predictable monthly installments. This is especially true for categories like travel, SaaS, education, and premium digital services.

With Credit Card EMI now live on xPay for international payments, Indian merchants can offer a powerful financing option to global customers while still receiving full settlement upfront in INR. This fundamentally changes how cross-border checkout works for high-ticket transactions.

This guide explains what Credit Card EMI means in the international payments context, how widely it is used globally, why it matters for Indian merchants selling abroad, how it works technically, and the real business impact merchants can expect.

What is Credit Card EMI in cross-border payments?

Credit Card EMI allows customers to convert a purchase into fixed monthly installments using their existing credit card credit limit. Unlike standalone BNPL products, EMI does not require customers to open a new account or undergo additional credit checks.

In an international payments setup:

The merchant receives the full transaction amount upfront

The customer repays the issuing bank in monthly installments

Currency conversion, settlement, and compliance follow the merchant’s receiving country regulations, such as India

From the merchant’s perspective, EMI behaves like a standard successful card payment with guaranteed settlement. From the customer’s perspective, it significantly reduces upfront payment pressure.

Global adoption of credit card EMI and installment payments

Card-linked installment payments, including Credit Card EMI, have moved from an edge use case to a mainstream checkout expectation across markets.

Installments are now standard in global ecommerce

70–85% of large global ecommerce merchants offer some form of installment payments at checkout, including card-linked installments, BNPL, or hybrid models, according to multiple payments industry surveys (2023–2025).

Card-linked installment usage grew over 60% year-over-year in mobile commerce, driven by app-based purchases and high-ticket digital transactions.

Merchants report strong adoption across channels:

82% growth in in-store installment usage

68% growth in online installment usage

indicating that installment behavior is not limited to one channel or geography.

Consumers actively choose installment options

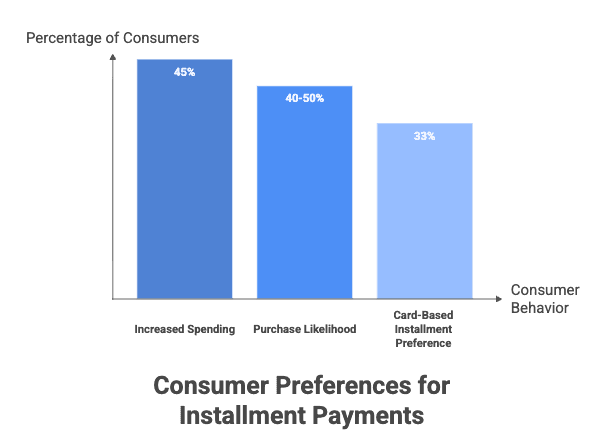

40–50% of shoppers globally say they are more likely to complete a purchase when installment options are available at checkout.

Nearly 45% of consumers report they would spend more per transaction if allowed to pay in installments.

1 in 3 consumers prefer card-based installments over standalone BNPL products, citing:

Trust in their issuing bank

Familiarity with credit card statements

No need to create or manage new financing accounts

This preference is especially pronounced for international purchases, where trust and predictability matter more.

Why international buyers prefer Credit Card EMI

International purchases often involve higher ticket sizes, FX considerations, and longer decision cycles. Credit Card EMI directly addresses these frictions.

Customers prefer EMI because:

It makes large purchases more affordable by spreading cost over time

Monthly payments are predictable and transparent

Existing credit cards can be used without opening new credit lines

Banks and card issuers are familiar and trusted, increasing payment confidence

For international buyers, EMI reduces hesitation at checkout and increases the likelihood of completing a purchase.

Industries where Credit Card EMI has the highest impact

Credit Card EMI consistently performs best in industries with higher average order values or upfront commitments.

Common use cases include:

Travel and tourism, such as international flights, holiday packages, and hotel bookings

SaaS and software, especially annual or multi-year subscriptions

Education and professional services, including certifications and cohort-based programs

Consumer electronics, where customers prefer spreading device costs

Premium and luxury goods, where EMI lowers psychological price barriers

Medical and wellness tourism, where treatment costs are planned in advance

These categories benefit disproportionately because customers are sensitive to upfront cost, even when they have sufficient credit.

How Credit Card EMI works technically

The EMI flow is straightforward for customers, but involves multiple systems working together behind the scenes.

Checkout selection

At checkout, customers see Credit Card EMI as a payment option, along with available tenures and installment amounts.Issuer eligibility check

The card network and issuing bank determine whether the card supports EMI and whether the transaction qualifies based on amount and card policy.Conversion to EMI

Once approved, the issuing bank converts the transaction into an installment plan and shares the repayment schedule with the cardholder.Merchant settlement

The merchant receives the full transaction value upfront, just like a normal card payment.Currency conversion and remittance

For Indian merchants, funds are settled through regulated cross-border channels, converted to INR, and remitted with the appropriate compliance metadata.

All installment risk and collection responsibility remains with the issuing bank, not the merchant.

Credit Card EMI on xPay: how it works end to end

xPay is the only platform enabling Credit Card EMI for international payments for Indian merchants, built from the ground up with compliance, routing intelligence, and settlement efficiency.

Local acquiring and issuer-friendly routing

xPay partners with licensed processors and banks across key international markets. EMI transactions are routed in a way that aligns with local issuer expectations, improving eligibility and authorization success rates compared to generic cross-border card flows.

Upfront settlement with compliant remittance

Even though customers pay in installments, merchants:

Receive the full amount upfront in INR

Are settled via regulated AD1 banking channels or PA-CB providers

Do not face repayment risk or delayed cash flow

Compliance built into the flow

Each EMI transaction processed via xPay:

Uses correct purpose codes

Follows FEMA and RBI-aligned settlement paths

Generates GST-compliant FIRCs instantly

Maintains a clean audit trail

This removes the operational complexity that typically accompanies cross-border financing options.

Unified visibility and reporting

Merchants can track EMI performance directly within xPay:

EMI adoption by country and tenure

Conversion and approval rates compared to non-EMI transactions

Settlement timing and FX impact

This makes EMI a measurable growth lever rather than a black-box feature.

Business impact for merchants

Merchants enabling Credit Card EMI on xPay typically see:

Higher conversion rates, especially for international customers facing large upfront payments

Increased average order value, as customers choose higher-priced plans or packages

Lower checkout abandonment, driven by improved affordability

Stronger customer loyalty and repeat purchases, particularly in subscription and service-based businesses

In practical terms, EMI shifts payments from being a checkout constraint to a growth driver.

Real-world examples

An international travel merchant offering EMI on high-value bookings saw a significant increase in checkout completion and a meaningful lift in average order value after enabling installments.

A global SaaS company offering annual plans observed higher close rates on enterprise subscriptions when EMI was available as an option for international customers.

These outcomes are consistent across categories where upfront cost previously limited conversion.

Key considerations for enabling EMI

Merchants should:

Clearly display EMI tenures and installment amounts at checkout

Monitor EMI approval and success rates by geography

Track EMI share of total volume and its impact on AOV

Ensure settlement and accounting workflows are aligned

With the right setup, EMI integrates seamlessly into existing payment operations.

FAQs

Does Credit Card EMI affect merchant settlement timing?

No. Merchants receive the full payment upfront.

Is EMI riskier for merchants than full payment?

No. The issuing bank assumes all repayment risk.

Do all international cards support EMI?

Support depends on issuer policies and geography, but many major markets have broad EMI coverage.

Is Credit Card EMI the same as BNPL?

No. EMI uses an existing credit card’s credit line, while BNPL is a separate financing product.