Chargebacks, Friendly Fraud, and Dispute Management for Global Merchants (2026 Playbook)

If you sell globally, chargebacks are not a rare edge case anymore. They are a predictable cost line item. And if you do not manage them well, they start showing up as:

Lower approval rates

Higher reserve and withholding risk

More manual ops work

Worse unit economics

This guide breaks down what chargebacks really are, why friendly fraud is rising, what card networks care about (and penalize), and how global merchants can run a tight dispute program that protects revenue.

We will also show how xPay helps reduce disputes upfront and makes resolution much easier once they happen.

What is a chargeback?

A chargeback is when a customer disputes a card transaction with their bank. The bank pulls the money back while the case is reviewed.

Typical reasons fall into three buckets:

Fraud: “I did not make this purchase”

Service / product: “Item not delivered”, “Not as described”, “Cancelled but still charged”

Confusion: “I do not recognise this descriptor”, “Duplicate charge”, “Subscription I forgot about”

We define chargeback rate as the percentage of sales that become chargebacks, and notes that “average” varies widely by category.

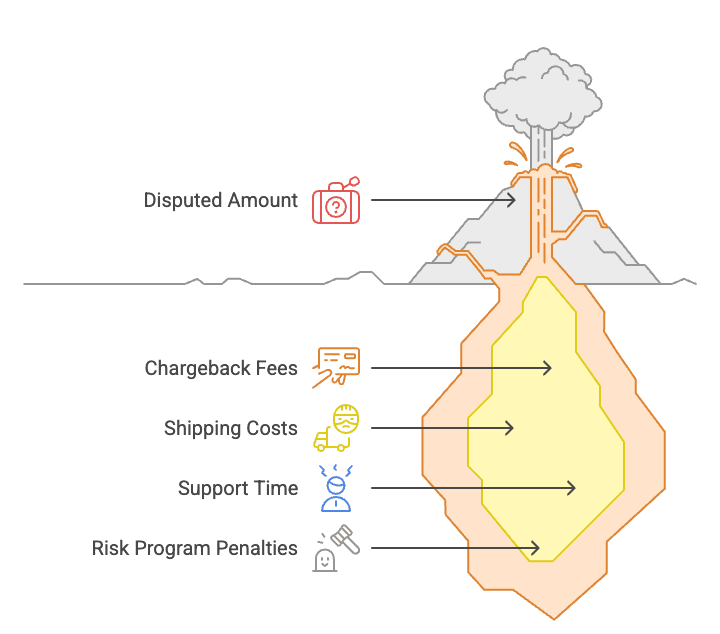

The real impact is not just the disputed amount.

Friendly fraud is growing (and it is not always “friendly”)

Friendly fraud (also called first-party fraud) is when the customer made the purchase but still disputes it.

This is rising for a simple reason: disputing has become one tap inside banking apps, and merchants often lose on documentation gaps.

A few data points worth knowing:

xPay cites a Juniper Research estimate that chargeback fraud cost businesses ~$20B in 2021.

We also noted in one survey, 23% of respondents admitted to engaging in friendly fraud.

We saw that in a 2025 survey, businesses identified 45% of their chargebacks as fraudulent in the context of arbitration.

A Mastercard sponsored study (via Datos Insights) projected $15B in fraudulent chargeback losses in 2025, with global chargeback volume projected to grow further

For global merchants, this means one thing: even if your product is great, disputes can still rise unless you proactively prevent them.

Network thresholds matter because penalties are real

Card networks track disputes and can place merchants and acquirers into monitoring programs if dispute ratios are high.

Visa’s programs have evolved and thresholds can vary by region and program type. The earlier VDMP “standard” dispute-to-sales threshold of 0.9% (plus volume conditions).

Visa’s newer monitoring approach (VAMP) has introduced updated thresholds and timelines, and multiple industry summaries indicate tighter scrutiny over time.

What this means in practice:

Even if you win disputes, your dispute volume can still create pressure on your processing stack.

High dispute ratios can reduce approval rates over time because risk systems get stricter.

Operationally, you can face reserves, settlement holds, or account review.

This is why serious merchants treat dispute ratio as a core metric, not a legal afterthought.

Dispute management that actually works

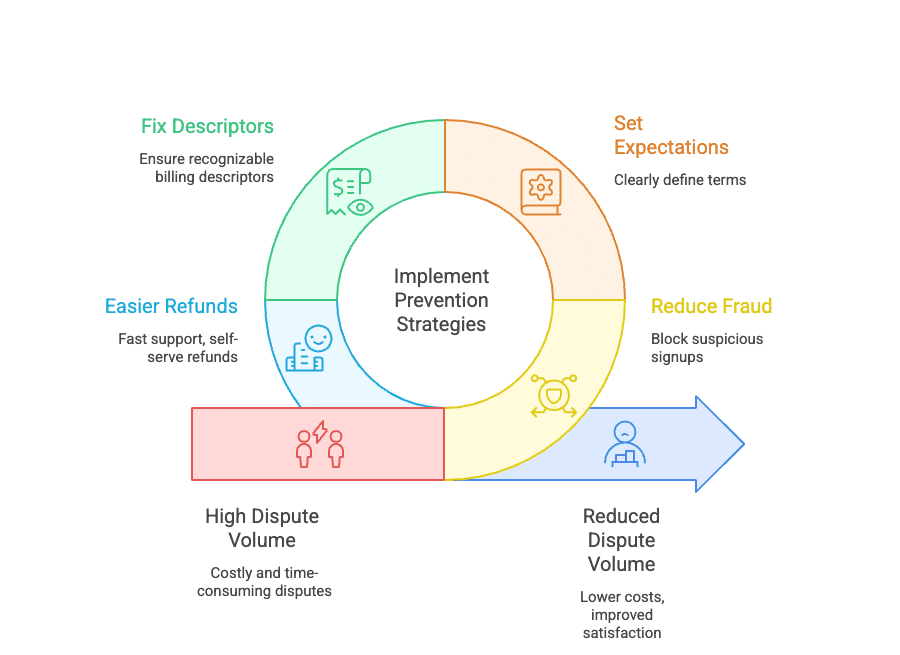

Most “chargeback strategies” fail because they focus only on fighting disputes after they happen.

Real dispute management has three layers:

Layer A: Prevent disputes before they are filed

This typically drives the biggest ROI.

Best levers:

Reduce fraud at the door: block suspicious signups, velocity abuse, mismatched geo signals, risky device fingerprints

Set expectations clearly: pricing, refunds, delivery terms, cancellation policy

Fix descriptor confusion: recognizable billing descriptors + receipts that match what users remember

Make refunds easier than disputes: fast support, self-serve refunds, cancellation flows

Layer B: Respond fast and submit the right evidence

When a dispute happens, speed and evidence quality decide outcomes.

Common winning evidence:

Proof of delivery or service consumption

User login evidence, device and IP consistency

3DS or authentication logs where applicable

Refund policy acceptance (checkbox, timestamp)

Customer communications

We emphasize tracking dispute volume, rate, and outcomes inside the dashboard, because these metrics directly impact risk.

Layer C: Learn and close the loop

Every dispute is data.

You should tag and review:

Which SKU or plan triggers disputes

Which countries or issuers are worse

Which refund flows reduce disputes

Which customer segments drive repeat disputes

Then update your rules and flows monthly.

How xPay helps global merchants

xPay is built for Indian businesses selling globally, but the chargeback problem is universal. Our approach is simple:

Prevent: built-in Risk Engine

xPay’s in-built Risk Engine evaluates 61 parameters to reduce fraud-to-sales risk and dispute creation upstream.

This matters because once a dispute is filed, you are already paying the tax. Prevention is the cheapest win.

Protect: Chargeback Protection / Insurance

For a small fee, xPay offers chargeback protection where we take on the financial liability for eligible chargebacks.

This is useful for:

Newer merchants scaling internationally

High growth campaigns with unpredictable fraud spikes

Categories where friendly fraud is structurally higher

Resolve: clear dispute metrics + hands-on support

Disputes are won with operational discipline.

xPay provides:

Clear dispute metrics on the dashboard (volume, ratio, outcomes)

Support for resolution so your team is not stuck doing manual back and forth

A process that is built for speed and predictability

Net effect: fewer disputes, less revenue leakage, and lower ops load.

Practical checklist for global merchants

If you want to tighten dispute management in the next 30 days, do this:

Prevention

Add clear refund and cancellation terms to checkout and receipt

Fix billing descriptor confusion

Add velocity limits and geo checks

Flag repeat disputers and high-risk cohorts

Operations

Define an internal SLA for dispute responses

Maintain an evidence checklist per dispute reason

Track dispute ratio weekly, not monthly

Commercial protection

Consider chargeback protection if disputes meaningfully impact margins or cash flow

Review your high-risk markets and payment methods monthly

FAQs

Are disputes counted even if the merchant wins?

Networks and risk systems often track disputes received as a key risk indicator, even when outcomes vary. This is why lowering disputes upstream matters.

What is a healthy chargeback rate?

It depends on category, but the best operators stay comfortably below network monitoring thresholds and actively manage dispute drivers.

Why do “good” customers file disputes?

Friendly fraud, confusion, subscription forgetfulness, and the convenience of one-tap bank disputes are major drivers.

Ready to Keep More of Every Dollar You Earn?

Try xPay free for 30 days - pay 0 % fees, test real results.

Start accepting Apple Pay, PayPal, international cards, and 40+ methods, with the Lowest fees and instant FIRC.

Stop leaking revenue to FX spreads, failed OTPs & wire fees.

xPay is the international payment gateway built for Indian businesses.

Get 1 Month Free – Zero Transaction Fees

Ready for clearer, cheaper global payments?

Start Your One-Month ZERO Fees Trial with xPay.