As an Indian business, should I set up a US entity

You’ve nailed it in India, and now it’s time to take your business global. But here’s the big question: do you need to set up a US entity, or can your Indian business do the job just fine? Setting up a US company sounds fancy, but it comes with its share of paperwork, costs, and headaches. In this blog, we’ll break down your options, give you the lowdown on the US entity setup process, and show you why sticking with your Indian business might be the smarter, simpler choice for world domination!

Why Is Setting Up a US Entity a Popular Option for Indian Businesses going Global?

The American market is a goldmine for businesses. Whether you’re in tech, retail, healthcare, or any other industry, the US offers unmatched opportunities. Here’s why it’s such a tempting choice:

Massive Market Access: Tap into a diverse consumer base of over 330 million people with significant buying power.

Legal Protection: Benefit from a transparent, entrepreneur-friendly legal framework.

Enhanced Credibility: Gain global trust and attract funding from investors and public markets.

Innovation Opportunities: Access cutting-edge research and network with industry leaders.

The two main ways to set up a US entity

Setting up a US entity while sitting in India boils down to two options:

Tools like Stripe & Clerky

Forget about this one. It's non-compliant for Indian businesses! 🚫

You can’t pay foreign services like Stripe directly to set up your entity — RBI rules require routing money through an AD bank.

Even Stripe itself discourages Indians from using their service for this.

The ODI Route via Your CA

Brace yourself for complexity!

No direct ownership in the US entity is allowed. Instead, you must create Indian LLPs to own the US entity.

Want to pay yourself? You’ll need to set up an Indian entity to route funds.

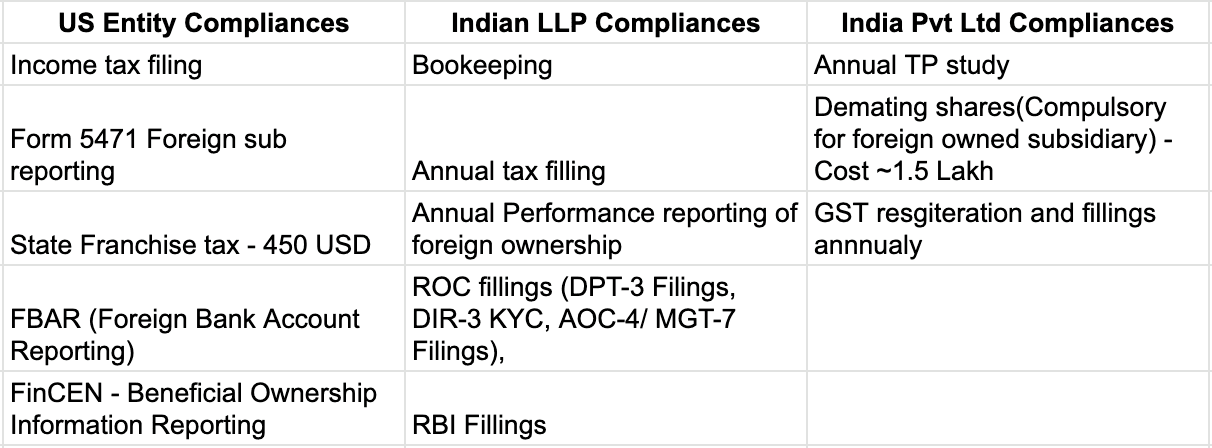

The process takes 6-8 months, costs $10–$15k, and involves ongoing annual compliance.

It's a journey, but with the right guidance, it's doable! 🌟

The Process of Setting Up a US Entity from India

Pre-2022, Indian businesses used to set up a US entity typically via the GIFT route where the US entity would be established temporarily in the name of a US relative who could then gift their ownership in the entity to Indian nationals.

However, the ODI regulations laid down in 2022 ruled out this option.

Setting up a US entity via the ODI route as an Indian business is a multi-step journey that involves both compliance with Indian regulations and navigating the US corporate setup process. Here's a quick rundown:

Step 1: Comply with RBI’s ODI Regulations

File Form ODI, submit a Net Worth Certificate, provide ownership proof, and file an Annual Performance Report (APR) to stay compliant with RBI guidelines.

Skipping ODI regulations can lead to fines of up to ₹10 crores, a ban on future investments, and even imprisonment of up to three years under FEMA violations.

Step 2: Incorporate the US entity

Pick a Structure:

LLC (pass-through taxation, great for smaller operations)

C-Corp (better for attracting investors)

Choose a State:

Delaware: Popular for business-friendly laws

Wyoming: More affordable, with low taxations

Register Your Biz: File with the state and pay incorporation fees (varies by state).

Appoint a Registered Agent: Must be US-based to accept legal documents.

Obtain an EIN: Employer Identification Number from the IRS, essential for tax purposes and hiring.

Post getting your EIN, you can open bank accounts with established players like Chase, Bank of America etc.

Step 3: Set Up Indian LLP Entities

Register LLPs in the names of the founders. The process includes obtaining DSC, applying for DPIN, and filing incorporation documents. This typically takes about 15-30 days.

Step 4: Set Up Indian Private Limited Company

Incorporate an Indian Private Limited Company. Key steps: obtain DSC and Director Identification Number (DIN), secure name approval, and file incorporation documents. This also takes around 15-30 days.

Step 5: Execute ODI Transaction from Indian LLP to US Entity

Transfer funds from the Indian LLP to the US entity under the ODI framework. The procedure involves:

Submit Documents to Authorized Dealer (AD) Bank

AD Bank Scrutiny: The bank reviews documents to ensure compliance.

Report the transaction to the RBI.

This process can take approximately 2.5 months.

Step 6: Execute FDI Transaction from US Entity to Indian Entity

Facilitate the FDI transaction from the US entity to the Indian company. Ensure compliance with FDI regulations and report the transaction to the RBI. This process also takes around 2.5 months.

Having a US entity is not a casual weekend project — it’s a full-on business marathon.

Disadvantages of a US Entity for Indian Businesses

Now the big question: Is setting up a US entity worth it? 🤔

2x the Work, 4x the Pain

Managing two entities means twice the headaches. You’ll need to handle separate compliance, filings, and financial systems for both Indian and US entities — even if only one is actively running operations or incurring expenses. This duplication significantly increases time, effort, and costs.

Sales Tax Chaos

In India, GST rates vary by item or service. In the US, sales tax adds another layer of complexity — not only does it vary by product or service, but every state has its own rules. Selling across states means navigating a maze of laws, rates, and filing requirements, making compliance a tedious affair.

Tax Trap for Success

Success comes with a price — quite literally. If you decide to flip back to an Indian entity after building a successful US parent entity (like Razorpay did), you could face tax bills running into hundreds of millions. This makes scaling globally a high-stakes decision.

Transfer Pricing Troubles

Transfer pricing laws mandate that Indian entities must show a minimum profit margin of 15% on inter-company transactions. This profit is then taxed at a corporate tax rate of ~25%, effectively costing you ~4% of the transaction value — and that’s before factoring in forex losses when converting USD to INR. When compared to accepting payments directly into an Indian entity, this route becomes significantly more expensive and complex.

While the US entity opens doors to global opportunities, the road is paved with paperwork and expenses. Balancing the benefits with the challenges is key — and sometimes, simpler alternatives like strategic partnerships or global payment platforms may save the day!

Why Operating Through an Indian Entity Makes More Sense?

Traditionally, to do business in the US, an Indian company would need to jump through countless hoops as listed above. Add to that the hassle of securing a US bank account, dealing with payroll compliance, and figuring out how to repatriate earnings.

IT’S THE OLD WAY OF DOING GLOBAL BUSINESS!

The game has changed. Solutions like xPay are here to simplify this entire process, no US entity required. With xPay, Indian businesses can:

Accept and settle payments in USD while staying compliant with global regulations.

Manage cross-border transactions seamlessly, eliminating the need for costly intermediaries.

Handle sales tax complexities, ensuring proper calculation and reporting for US-based transactions.

In short, xPay offers a comprehensive, end-to-end solution for payments and compliance, letting your Indian entity operate globally with ease. Why spend months setting up a US entity when you can hit the ground running with your existing setup? It’s global business, reimagined — leaner, faster, smarter.

Conclusion: What’s the Right Move for You?

Setting up a US entity isn’t a golden ticket — it’s a tool, and like all tools, it’s only useful when truly needed. If your business faces regulatory requirements or a need for a local presence to crack specific contracts or markets, go for it. Just be ready for the time, effort, and cost involved.

But if your goal is simply to expand sales, manage payments, or operate globally without the legal and financial tangles of incorporation, sticking with your Indian entity might be the smarter play. With solutions like xPay, you can navigate cross-border compliance, handle payments, and even manage tax obligations — all without the baggage of US entity upkeep.

In short: set up a US entity if you must — otherwise, work smarter, not harder. The world’s waiting, minus the paperwork!

If you’re interested to sign up for xPay, connect with us here: https://bit.ly/xpay-get-in-touch