Accept Apple Pay, Klarna & Local Payment Methods: A Guide for Indian Exporters | xPay

Indian exporters looking to grow internationally need more than just a good product. If you're not offering local payment methods like Apple Pay, Klarna, or iDEAL, you're likely losing conversions.

This guide breaks down:

Why local payment methods matter

Most-used methods in your top export markets

How to enable Apple Pay, Klarna, and more

A real-world case study showing how success rates jumped with xPay

Why Indian Businesses Must Offer Local Payment Methods

Your international customers don’t all use cards. In fact:

40% of shoppers abandon carts if they don’t see familiar payment methods

Local methods can lift conversion rates by 30%+

Nearly 50% of global online transactions are now completed with digital wallets instead of cards.

Key Benefits:

Higher trust & conversion: Customers feel safer using Klarna, iDEAL, Apple Pay, etc.

More payment success: Local routing avoids unnecessary declines

Faster global growth: Easier for new markets to buy from you

Fewer hidden costs: Many local methods come with lower FX/spread fees

Top 10 Export Markets & Their Payment Preferences

1. USA

✓ Apple Pay (used by 60 M+)

✓ Klarna (used by 42 M+ Americans)

✓ PayPal, Cards

2. UK

✓ Apple Pay, Klarna, Clearpay

✓ Cards + 3DS

✓ PayPal

3. Germany

✓ Klarna Pay Later, Sofort

✓ SEPA Direct Debit

✓ PayPal

4. Netherlands

✓ iDEAL (used for 58% of all transactions)

✓ Apple Pay

5. UAE

✓ Apple Pay, Samsung Pay

✓ Cards, Bank Transfers

✓ BNPL: Tabby, Tamara

6. Australia

✓ Apple Pay, Afterpay, Klarna

✓ Cards

✓ PayPal

7. Singapore

✓ PayNow, Apple Pay, GrabPay

✓ BNPL: Hoolah, Atome

8. Canada

✓ Apple Pay, Interac, and Cards

✓ Klarna growing

9. Saudi Arabia

✓ Mada, STC Pay, Apple Pay

✓ BNPL: Tabby, Tamara

10. South Africa

✓ Instant EFT, SnapScan, Cards

✓ PayPal

Apple Pay: Why It's Essential for Global Payments

Used by 640 M+ users in 70+ countries. Supports one-tap payments on mobile.

Key Stats:

✓ Used in 92% of mobile wallet transactions in the US

✓ Boosts mobile conversions by up to 58%

✓ Accepted by 85% of US retailers

Benefits:

Super fast checkout = more completed payments

Trusted by premium buyers (esp. Gen Z, millennials)

No form-filling, no OTP issues

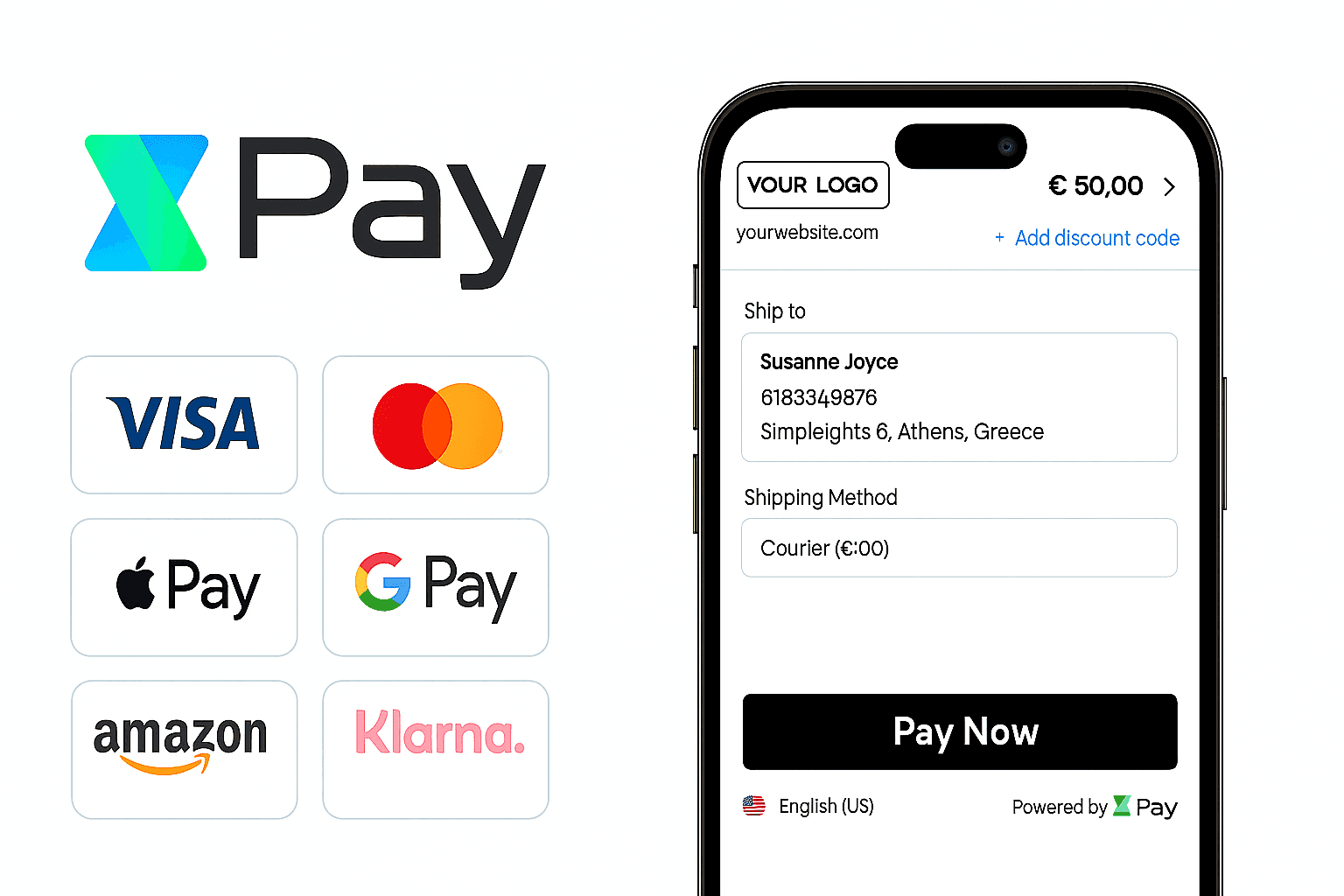

Want to accept Apple Pay as an Indian business? With xPay, you can.

xPay is the ONLY Indian payment gateway that offers Apple Pay for your international customers

You get paid in INR; your customer pays in their local currency

Klarna: The BNPL Powerhouse for Exporters

150 M+ users across 45 countries. Pay Later, Pay in 4, or Financing options.

Why It Matters:

✓ 30% higher AOV

✓ 85% of users say Klarna improves the buying experience

✓ Popular in Germany, UK, Nordics, US

Payment Flow:

The customer selects Klarna

Klarna pays you upfront

The customer pays Klarna later

Ideal for:

Fashion, electronics, SaaS, digital products

Any product >$100

Comparison: xPay vs. Other Payment Gateways

Provider | Local Methods | FX Markup | FIRC | Success Rate | Fees |

|---|---|---|---|---|---|

xPay | ✓ Apple Pay, Klarna, iDEAL, ACH, SEPA | Lowest | ✓ Instant | 92%+ | Lowest |

Stripe | ✓ Strong (APM leader) | ~2% | ✗ Manual | ~90% | ~4.9%+ total |

Razorpay | ✗ Limited (no Klarna, iDEAL) | ~4-6% | ✓ Manual | ~70% | ~4-5% + GST |

PayPal | ✓ PayPal only | ~3-4% | ✓ Aggregated | Moderate | ~7.4%+ total |

Skydo | ✓ Bank transfers only | ~2-4% | ✓ Instant | Good (Wire only) | ~3-4% |

LemonSqueezy | ✓ Apple Pay, Cards | ~2-4% | ✗ None | Good (small scale) | ~5-8% |

Why xPay Is the Best International Payment Gateway for Indian Businesses

If you're serious about global sales, you can't afford payment friction. Here's why xPay is the best payment gateway for international payments in India:

✓ Accept Apple Pay, Klarna, iDEAL, ACH, and 40+ other global methods

✓ 0% forex markup — real mid-market rates

✓ Highest success rates in India for global cards & wallets (92%+)

✓ Automated FIRC

✓ Fast onboarding and world-class support

Real Case Study:

One late-stage Indian startup A/B tested xPay vs. Razorpay:

92% vs. 70% success rate

43% vs. 33% conversion rate

Result: 29% revenue boost just by switching payment gateway

Ready to Upgrade Your Payment Game?

Stop losing revenue to failed payments and missing methods.

With xPay, you get:

✓ Friction-free global payments

✓ Local payment methods your customers already use

✓ Transparent pricing, instant FIRC, and compliant onboarding

Get 1 Month Free – Zero Transaction Fees

Ready for clearer, cheaper global payments?